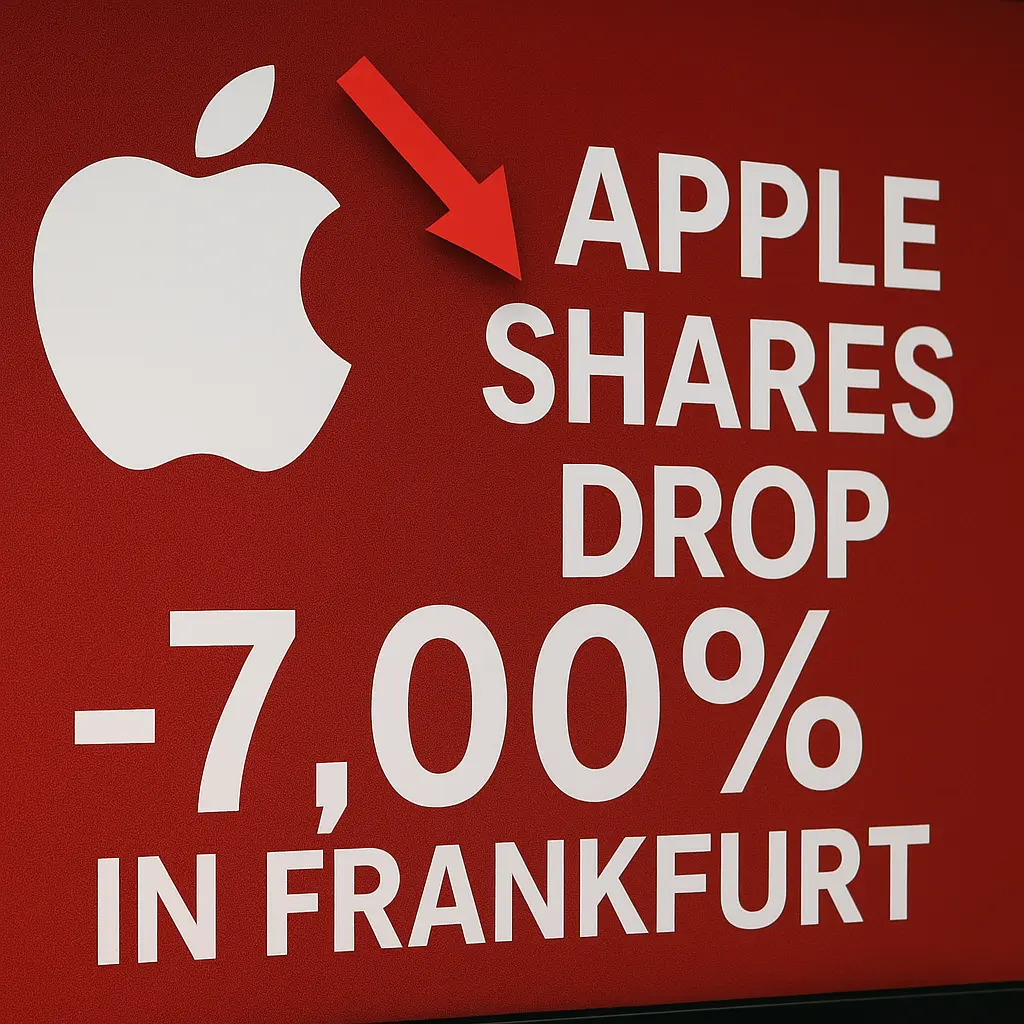

Shares of Apple Inc. plunged nearly 7% on the Frankfurt Stock Exchange early Thursday, following former U.S. President Donald Trump’s declaration of sweeping new tariffs on Chinese imports if he wins a second term in the upcoming 2024 U.S. election. The market reaction signals investor anxiety over renewed trade tensions and potential disruptions to Apple’s deeply integrated supply chain.

The decline marks Apple’s sharpest single-day drop in the German market in over a year, reflecting broader concerns among European investors about the impact of escalating geopolitical risks on global technology firms.

Trump’s Tariff Pledge Sends Shockwaves

At a campaign event in Ohio late Wednesday, Trump announced his intention to impose a 60% blanket tariff on Chinese goods if re-elected. The proposal is part of a larger strategy to curb Chinese manufacturing dominance and promote American industry. However, analysts warn such measures could severely affect companies like Apple, which rely on China for both manufacturing and key components.

“Apple is caught in the crossfire of U.S.-China trade politics,” said Sophie Meier, a senior equities analyst at Frankfurt-based Borsen Research. “With most of its iPhones and other devices assembled in China, any increase in import costs would directly impact margins or consumer prices.”

European Investors React Swiftly

While U.S. markets were yet to open, early trading in Europe reflected immediate investor jitters. Frankfurt-listed Apple shares fell by over 6.8% before stabilizing slightly in afternoon trading. The broader tech-heavy DAX index also slipped, dragged down by related supply chain and electronics firms.

The eurozone’s reaction underscores the global sensitivity to U.S.-China trade relations, especially given Europe’s role as both a consumer and manufacturing hub for American tech companies.

Impact on Apple’s Global Supply Chain

Apple has made strides in diversifying parts of its manufacturing to countries like India and Vietnam, but the majority of its core production remains in China. The proposed tariffs could lead to significant cost increases if Apple continues importing Chinese-assembled devices into the U.S. market.

“This tariff move puts Apple in a difficult position. Either it absorbs the cost, hurting profit margins, or passes it onto customers, which could affect sales,” said Jan-Erik Bauer, a tech market strategist based in Munich.

Apple has not issued a formal statement in response to the tariff comments, but industry insiders suggest that its executive team is monitoring the situation closely.

Wider Market Implications

The tariff announcement also hit shares of other global tech players, including Samsung, ASML, and Foxconn-linked suppliers, which experienced notable losses in European trading. Semiconductor firms with ties to China saw particularly sharp declines amid concerns about future sanctions and export restrictions.

Meanwhile, the euro weakened slightly against the U.S. dollar, as investors sought safer assets amid mounting geopolitical uncertainty.

Looking Ahead

With the U.S. presidential election heating up, markets are expected to remain volatile as Trump’s campaign rhetoric ramps up. Analysts say Apple and other tech giants may face renewed pressure to accelerate supply chain diversification and prepare contingency strategies for worst-case trade scenarios.

“This isn’t just about one company,” added Meier. “This is about the future of global tech manufacturing in an increasingly protectionist world.”

TECH TIMES NEWS

TECH TIMES NEWS